If your new to property investing and being a landlord, one of the first questions you are likely to ask yourself when considering purchasing a buy to let property, is which type of mortgage should you choose for your investment.

So, should you choose a repayment or interest only mortgage? Most property investors and landlords use interest only mortgages, and there are a number of reasons for this. Fewer investors use repayment mortgages and I will cover the pros and cons for both types of mortgages in more detail below.

A mortgage is not only a debt, but it’s more than likely the largest type of debt that any individual will commit to in their lifetime. It’s very important that you understand how debt works and that you understand that there is a huge difference between ‘good debt’ and ‘bad debt’. Successful investors use good debt to their advantage and to accelerate their progress within their business’s.

Contents

Definition Of Bad Debt With Some Examples

In accounting terms, and as defined by Wikipedia, bad debt is a monetary amount owed to a creditor that is unlikely to be paid. In other words, debt that cannot be recovered. In investing terms, bad debt is debt that is used to purchase something that does not provide an income and depreciates over time.

The purchase of a family car which is used for vacations, leisure time, and even commuting to work, is a great example of this. Irrespective of whether you purchase the car second hand, or from an approved used dealership, or even brand new, the car will eventually be worthless over time and will end its days on the scrap heap. The value of the car will at some point have a zero balance.

Credit cards are another example of bad debt. In fact, I would argue that credit cards are the worst form of debt as interest rates are typically higher than any other types of borrowing. But they are popular because of the convenience, flexibility and the fact you only have to pay back the amount you have spent.

Loans are agreed on a fixed amount over a fixed period of time whereas credit cards have a fixed limit, but when used, the amount spent can be repaid over a flexible length of time and you only pay interest on the amount you have used and not the full limit of the card. Credit cards have a pre approved limit that can be used by the customer as and when they feel the need.

Common expenses on credit cards include holidays, tickets to events, furniture, household appliances, clothing; the list goes on.

Although there are some payment protection benefits and loyalty reward benefits when making purchases with a credit card, all the items listed above will end with a zero balance. If you pay your credit card bill in full each month you will avoid paying any interest on your purchases, but statistics show that the gap between the amount borrowed and the repayments made has increased in the UK since February 2013, with 53% of credit card holders incurring interest on their outstanding balance.

Definition Of Good Debt With Some Examples

Good debt is a purchase that will grow in value, or generate long term income, OR both.

Now, there is a huge amount of controversy around peoples opinions of good debt. And this is because of the lack of financial education we receive and the sales pitches from institutions that sell us products and services, who convince us that we are making a good choice in spending our money with them.

For example, some people will consider student loans that are used to pay for education as a good debt. But there aren’t any guarantees that people will secure a job in the industry that they have studied. And if they don’t, can that really be considered as good debt?

I agree that they will be giving themselves a better chance for employment than some, but their chances are not as good as someone who has already secured an apprenticeship or a scholarship with an organisation, who in addition, will not need to commit to any form of debt.

A business loan is also not necessarily an example of good debt. A person who takes out a loan to set themselves up in business isn’t guaranteed to succeed. So if the business fails they will have burdened themselves with debt that they are still responsible for without any additional income.

However, a business that already has a customer base and good reputation that is looking to purchase more equipment or materials to meet an increase in demand, would be considered a good debt as their bottom line will reflect the use of the loan to increase their output.

A buy-to-let property has the potential to grow in value over a long period of time whilst generating a regular income. With a small amount of the right knowledge, anyone can buy a good performing rental property. Borrowing to purchase an investment property is at the top of the list in terms of good debt in my opinion. It cannot be beaten!

Does that mean that any property purchased with a mortgage would be a good investment. NO! But what I am saying, is if you take the time to understand the property and rental market and do your research before you buy, then you will significantly reduce the risk of your purchase failing to produce a regular income for you.

Good debt has the potential to increase a person’s net worth. So ask yourself, are you borrowing money to buy a depreciating asset or an appreciating asset? If what you are purchasing won’t go up in value or generate an income for you, then you shouldn’t go into debt to buy it.

Cashflow is king and the lifeblood of any business, and property investing is a business. So lets now look at the two different types of mortgages you can use to purchase a buy-to-let property.

Repayment Mortgage Explained

Monthly payments that are made on a repayment mortgage, pay back both the interest and the capital of the loan. Providing you keep up with the repayments, you are guaranteed to pay off the whole loan by the end of the mortgage term. This is typically 25 years, but the term can be shorter, or even longer depending on the lender and market conditions.

The monthly repayments are higher than an interest only mortgage because you are paying back the capital which was borrowed in addition to the interest.

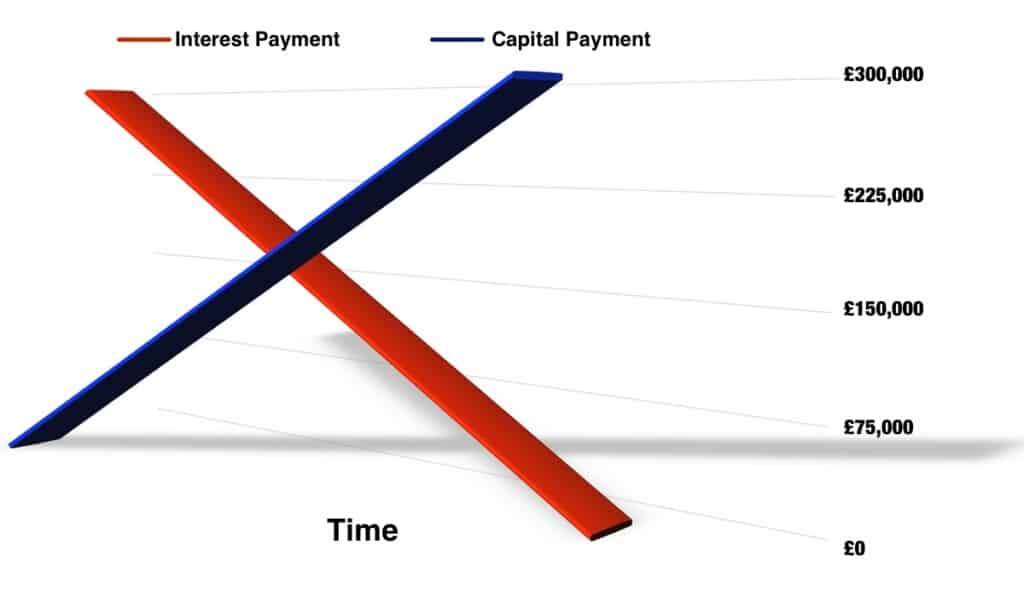

The amount you pay can be fixed, and the majority you pay back at the start of the loan will be interest payments. But as time goes on you will be reducing the amount of capital owed, and the majority of your payments will go towards paying back the outstanding balance as opposed to the interest.

Repayment mortgages are more popular with home owners than they are with property investors and landlords.

Pros:

- The property is paid in full at the end of the mortgage term.

- If house prices fall, you are less likely to have negative equity.

- You may benefit from capital growth in the long term.

Cons:

- Monthly payments will be higher compared to an interest only mortgage.

- You can only offset the interest element on your income tax bill (more on this later).

Interest Only Mortgages Explained

Monthly payments on an interest only mortgage will be lower than a repayment mortgage, because you are not paying back the capital. You will still owe the original amount borrowed at the end of the mortgage term.

So why are interest only mortgages more popular with property investors and landlords?

Owning a rental property is a business, and business’s require a healthy cashflow to survive. In addition to regular expenses, there is also a requirement to maintain the property due to wear and tear, annual regulatory inspections and certificates, heating system breakdowns and other repairs.

The difference in monthly mortgage payments which are made on an interest only mortgage compared to a repayment mortgage, will increase the regular cashflow that is needed to operate and maintain a rental property.

I have written an article about calculating the income and expenses of a rental property which will help you assess a potential purchase before you buy.

There are also tax benefits as the interest-only cost of a mortgage is tax deductible. Although currently, there are limitations to this if you operate as a private landlord within the UK and are a 40 per cent tax-rate payer. Your interest tax relief will be capped at 20 per cent. Please seek specialist tax advice if you think this will affect you.

Pros:

- Lower monthly payments compared to a repayment mortgage.

- Greater tax benefits depending on your financial situation.

- You may benefit from capital growth in the long term.

- The value of the debt decreases over time due to inflation.

Cons:

- You will still owe the full amount of the property at the end of the mortgage term.

- You are at risk of having negative equity should there be a fall in the property market.*

- You will pay more in interest over the mortgage term because you are not making payments to reduce the capital owed.

*A fall in prices in the property market, does not equate to a fall in rents. Providing your rental income continues to be greater than your mortgage payments and other expenses, you can continue business as usual.

What Are Your Property Investing And Landlord Objectives?

If you are investing for security and potential capital growth in the long term with an option to sell in the future, or leave a legacy to your beneficiaries, then a repayment mortgage could be the best option for you.

If you are wanting to generate a regular income, with the potential of capital growth, AND also have the option to either refinance or pay the mortgage in full at the end of the mortgage term with another asset, and leave a legacy to your beneficiaries, then the interest only mortgage could be the best option.

There are certainly more options available to you when using an interest only mortgage. Some investors have a number of properties in their portfolio with the end goal being that they will sell most to pay for a few to hold.

This means that they have leveraged their spending ability to have other peoples money pay for the assets that they intend to keep.

My buy-to-let properties are all on interest only mortgages.

Additional thoughts:

Does anyone ever really own property outright? If you have an unencumbered property you are still liable to pay taxes, specifically Council Tax. If you fail to pay taxes, your assets can be stripped from you.

There are benefits to not actually owning assets. If you have a mortgage on a property, then technically you are not the owner of that property, the bank is. What you have is control of that property whilst you keep up with your mortgage payments.

With that said, if something terrible happened outside of your control which you are liable for, your assets would be protected as they cannot be stripped from you because you don’t actually own them.